In the fast-paced world of financial services, the role of HR technology has become mission-critical. As the industry navigates constant change and digital disruption, HR leaders are leveraging AI-powered, intuitive solutions to drive resilience, retain talent, and simplify complexity across their organizations.

This blog is an introduction to our latest research paper, The Top Six HR Tech Trends in Financial Services. From optimizing workforce efficiency through a lean approach to cultivating a future-ready workforce with technological learning and development (L&D), we explore how HR tech is redefining the industry's success.

We’ll also shed light on how HR technology is enabling teams to prioritize cybersecurity and compliance training to safeguard sensitive data and maintain regulatory compliance and uncover innovative tech solutions that are enhancing the remote employee experience, nurturing a cohesive organizational culture while miles apart.

Recognizing the immense value of diversity, inclusion, and belonging, we further explore how HR tech is paving the way for progressive workplaces that empower individuals from diverse backgrounds and venture into the disruptive realm of next-gen AI, specifically looking at how it's reshaping HR in financial services.

Chapters

- Using digital transformation to maintain a lean workforce

- Refocusing on skills with technological L&D

- Prioritizing cybersecurity and compliance training

- Maintaining the employee experience remotely

- Improving diversity, inclusion, and belonging

- The disruption of next-gen AI

1. Using Digital Transformation to Maintain a Lean Workforce

In the face of a challenging economic climate and evolving customer demands, financial institutions are turning to digital transformation to streamline operations and maintain a productive and lean workforce.

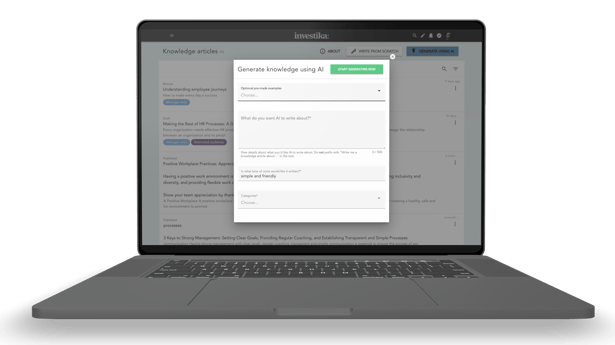

Automation and AI-powered technologies are revolutionizing traditional processes, from customer service to risk assessment. For the world of HR, by adopting AI-powered HRSD tech, banks and other financial service providers can reduce manual tasks, minimize errors, and improve overall efficiency, freeing employees and HR teams to focus on higher-value work.

2. Refocusing on Skills with Technological L&D

The pandemic drove technological innovation in employee experience, but many organizations implemented digital solutions without considering their workforce's diverse digital capabilities. Ironically, it is the most senior BFSI employees that often feel held back by their skills and are unaware of existing training opportunities available to them.

Making these resources more accessible, through intelligent, self-service tools, can bridge the skills gap, boosting employee confidence and retention. Financial service businesses must focus on digital skills, hiring for relevant expertise, and investing in upskilling and reskilling. Creating personalized journeys that guide employees to available training, delivered through intelligent, role-based experiences, will be vital for future-proofing these organizations.

3. Prioritizing Cybersecurity and Compliance Training

As financial institutions become more reliant on digital technologies, the risk of cyber threats and regulatory non-compliance increases. Many HR tools can help to prioritize cybersecurity and compliance training to mitigate these risks and now play a crucial role in upholding compliance, safeguarding data security, and facilitating employee training. Its functions can range from enabling managers to track outstanding mandatory training within their teams to crafting personalized, context-aware learning journeys that guarantee the highest levels of proficiency for specific roles and individuals.

4. Maintaining the Employee Experience Remotely

COVID-19 accelerated the shift towards remote work in the financial services sector. To ensure a positive employee experience (EX), HR tech will be the key to supporting the workforce and fostering engagement. Surveys indicate that 60% of banking employees faced difficulties with coaching, collaboration, and accessing essential information during the pandemic, primarily due to inadequate remote work technology.

AI-powered HRSD tech can help overcome these challenges by unifying communication, simplifying access to information, and delivering consistent support across locations. But HR must play a lead role in assessing the needs of their own employees and choosing the right tools that cater to these needs the most. This is where people analytics comes into its own.

5. Improving Diversity, Inclusion, and Belonging

HR technology is taking center stage in bolstering Diversity and Inclusion (D&I) initiatives within organizations. By enabling effective communication, providing accessible learning resources, promoting Employee Resource Groups (ERGs), collecting valuable feedback, and offering robust analytics, these platforms create a more inclusive and diverse workplace culture.

Additionally, HR technology enables organizations to track and measure the progress of their D&I efforts, ensuring data-driven decisions for improvement. Ultimately, these tools empower organizations to cultivate a positive and supportive environment for all employees.

6. The Disruption of Next-Gen AI

AI is set to revolutionize HR technology through task automation, improved decision-making, and increased efficiency. Leveraging AI enables companies to analyze extensive data, identify the best candidates, predict employee turnover, and customize training programs to individual needs. AI-driven chatbots and virtual assistants can also handle routine employee inquiries, freeing up HR personnel for strategic initiatives.

Next-gen AI is transforming HR Service Delivery tech, powering predictive analytics, intelligent automation, and hyper-personalized service experiences that make life easier for HR and employees alike. But HR must play a lead role in assessing the needs of their own employees and choosing the right tools that cater to those needs most effectively.

Conclusion

In these turbulent times, strong HR leadership will be pivotal in driving resilience, retention, and long-term growth in the financial services sector. Technology will undoubtedly be essential in supporting HR's efforts, but our research indicates that a considered approach to adopting AI-powered HRSD tech can elevate your employee experience, turning fragmented interactions into a unified, intuitive journey that meets the expectations of today’s workforce.

By embracing innovative technologies and leveraging their capabilities to enhance processes and employee experience, HR can position itself at the forefront of innovation. This will establish your team as forward-thinking leaders, ultimately setting your organization up for success with a more human-centered, data-driven approach to HR Service Delivery.

Want to apply these trends to your own

HR strategy?

Hit the button below and download the full version of our latest report:

The Top 6 HR Tech Trends in Financial Services.